Growing regulatory enforcement of the LEI across India promotes an identifier that can open doors to global trade and finance opportunities for the region’s MSMEs

Author: Xue Tan, Head of Business Development for Asia region at the Global Legal Entity Identifier Foundation (GLEIF)

The Legal Entity Identifier’s (LEI) star is rising in India. A wave of mandates from multiple regulators has harnessed the LEI’s unique ability to deliver transactional trust and transparency across different applications, and LEI adoption is growing as a result. Yet, in India’s economy, which is fuelled by Micro, Small, and Medium Enterprises (MSMEs), there is another very welcome side-effect of regulation driving increased LEI issuance throughout the country. The increasing normalization of the LEI as an integral tool for enabling business means that more MSMEs than ever have exposure and enhanced access to an identifier that could help them formally verify their identity across borders. As a result, it opens up their potential to engage in global trade and finance opportunities – many for the first time.

This blog post summarizes regulatory developments concerning the LEI in India. It also explores how growing country-wide acceptance of a universally recognized and trusted entity identifier could further strengthen regional MSMEs, which are already responsible for nearly a third of India’s gross domestic product.

Mandates Gain Momentum in India

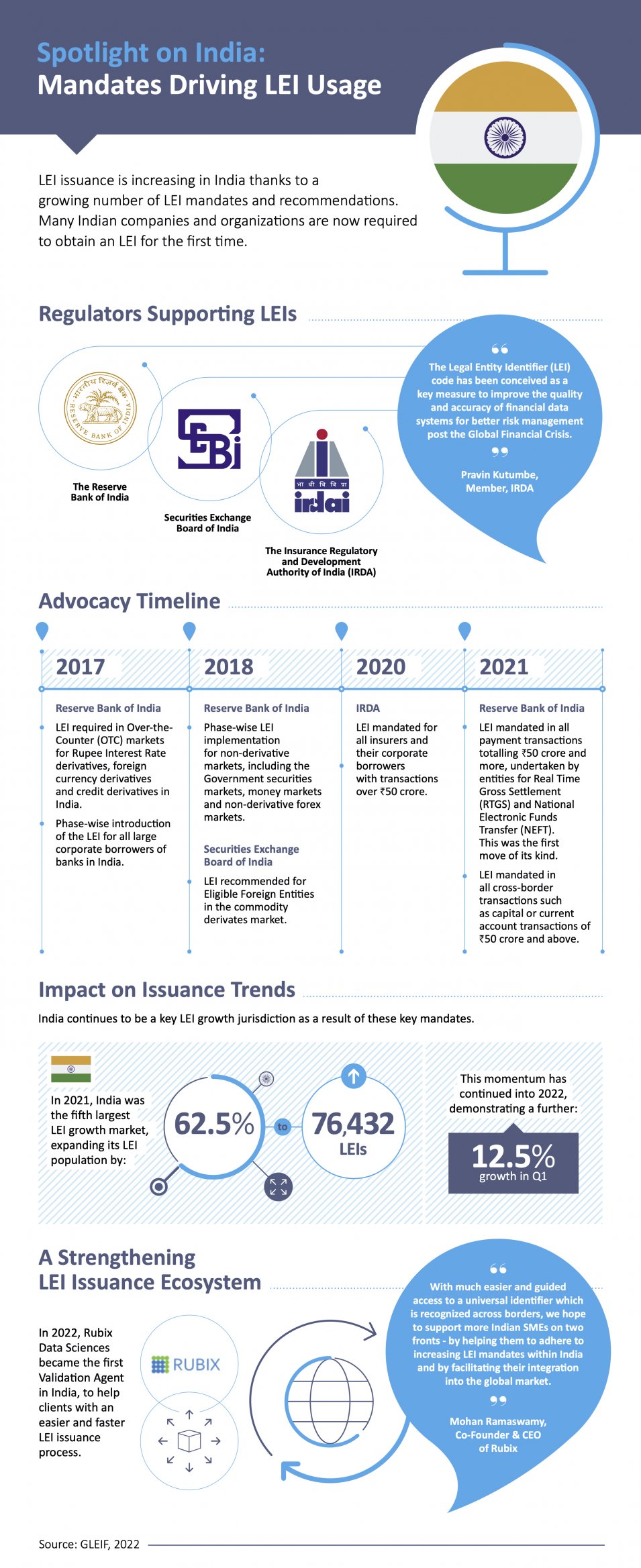

Proactive advocacy for the LEI has been building in India over the past five years and regulatory momentum, together with LEI issuance, continues to grow. Three prominent regulatory authorities have issued six LEI mandates and one recommendation during that time.

The Reserve Bank of India (RBI) was an early supporter of the LEI and introduced it back in 2017 as a necessary requirement for all participants in Over-the-Counter (OTC) markets for Rupee Interest Rate derivatives, foreign currency derivatives, and credit derivatives in India. In November of the same year, RBI followed up with the further phase-wise introduction of the LEI for all large corporate borrowers of banks in India. As a result, since the end of December 2019, entities without an LEI are not to be granted renewal or enhancement of credit facilities with exposure totaling ₹ 50 crore or more. A separate LEI roadmap for borrowers having exposure between ₹ 5 crore and up to ₹ 50 crores has been released end of April 2022.

In subsequent years, the RBI has proceeded to issue a further three mandates:

- In November 2018, a phase-wise implementation of the LEI was introduced for Non-derivative markets, including the Government securities markets, money markets, and non-derivative forex markets.

- In January 2021, and in a move that was the first of its kind, the LEI became mandatory in all payment transactions totaling ₹ 50 crore and more undertaken by entities for Real-Time Gross Settlement (RTGS) and National Electronic Funds Transfer (NEFT). This move is very timely – and may potentially set a precedent – at a global level, given the wider interest in making cross-border payments more transparent and inclusive.

- Most recently, in December 2021, the LEI was mandated in all cross-border transactions such as capital or current account transactions of ₹ 50 crore and above. The deadline to obtain an LEI for this purpose is 1 October 2022.

Another regulatory body that has recognized the opportunity to benefit from the LEI is the Securities Exchange Board of India. It recommended LEI usage for Eligible Foreign Entities in the commodity derivates market in October 2018. The Insurance Regulatory and Development Authority of India (IRDAI) followed in June 2020 with a mandatory requirement for the LEI for all insurers and their corporate borrowers with transactions over ₹ 50 crore.

A Sustained Upturn in LEI Issuance

The combined impact of these LEI mandates and recommendation is that a wide base of Indian companies and organizations are now required to obtain an LEI for the first time. The resulting increase in demand for LEIs across India in recent years is reflected in India’s position within GLEIF’s top five growth jurisdictions for LEI issuance in 2020 and 2021. Across those two years, the country marked 45.6% and 62.4% growth in annual issuance, respectively.

By the end of 2021, GLEIF reported that the total number of LEIs issued across the country had reached 76,432. And GLEIF’s expectation is that demand will continue to climb exponentially throughout this year and beyond as more and more entities register for LEIs as a result of existing and future mandates.

In a separate but complementary development, the Global Legal Entity Identifier System has recently expanded to service a further anticipated increase in regional LEI demand. In March 2022, Rubix Data Sciences announced that it had become the first Validation Agent in India. Rubix will work alongside Legal Entity Identifier India Ltd. (LEIL), a GLEIF accredited LEI issuer and a wholly-owned subsidiary of the Clearing Corporation of India Ltd., to help clients obtain LEIs.

The Validation Agent framework was launched by GLEIF in September 2020 to enable financial institutions, certification authorities, and fintech organizations to leverage their Know Your Customer and Anti-Money Laundering onboarding procedures to simplify their clients’ access to LEIs. Validation Agents play an important role within the Global LEI System. By equipping their client base with LEIs, they promote financial inclusion while creating value and opportunities such as cross-border supply chain relationships thanks to easier counterparty verification and simplified cross-border payments.

What are the Broader Benefits for MSMEs?

So how does the advancing regulatory landscape for LEIs, together with increased LEI issuance, provide a foundation for MSME growth in India?

MSMEs represent a significant and dynamic part of the Indian economy and make an important contribution to the economic and social development of the country. According to official sources, at the last count (in 2015-16) there were an estimated 63.39 million MSMEs in India, and in 2018-19, this base was responsible for generating 30.27% of GDP across the country. Yet many struggle to trade internationally or access finance as a result of not being able to prove their identity or trading history to the outside world.

With the growing ‘normalization’ of the LEI as a critical business enabler across the Indian economy, thanks to regulatory enforcement in certain transactions, an increasing number of MSMEs are being exposed to it or even obliged to obtain one. At the very least, awareness is growing, and access is certainly becoming easier, too, with the local activation of the Validation Agent framework. The ability to obtain robust business credentials, including a trusted business identity that can be used digitally, could be transformational for many small businesses, thanks to the many associated benefits. The simplification of international trade partnerships, the possibility of credit finance, and greater access to financial services are just a few of the most notable. And let’s not overlook the impact that strengthening the financial and supply chain inclusion of India’s MSMEs will have on the country’s economy. An increase in the flow of inbound capital will contribute significantly to India’s economic development.

So while it is the intention of India’s regulators to harness the LEI’s advantages to enhance trust and transparency within the banking and financial services ecosystems, it is important to recognize – and applaud – the wider economic benefits they are initiating by driving its adoption throughout the country. They are potentially setting the stage for Indian MSMEs to thrive in a global economy by promoting the widespread adoption of a trusted and verified identity that is recognized across international borders.

This article was originally published on GLEIF.org on May 12, 2022.